Alarming Chip Shortages: Where Is the Future When the Crisis Unfolds

The COVID-19 pandemic caused several companies to shut down, and the implications were reduced production and altered supply chains. In the tech world, where silicon microchips are the heart of everything electronic, raw material shortage became a barrier to new product creation and development.

During the lockdown periods, some essential workers were required to stay home, which meant chip manufacturing was unavailable for several months. By the time lockdown was lifted and the world embraced the new normal, the rising demand for consumer and business electronics was enough to ripple up the supply chain.

Below, we’ve discussed the challenges associated with the current chip shortage, what to expect moving forward, and the possible interventions necessary to overcome the supply chain constraints.

Challenges Caused by the Current Chip Shortage

As technology and rapid innovation sweeps across industries, semiconductor chips have become an essential part of manufacturing – from devices like switches, wireless routers, computers, and automobiles to basic home appliances.

To understand and quantify the impact this chip shortage has caused spanning the industry, we’ll need to look at some of the most affected sectors. Here’s a quick breakdown of how things have unfolded over the last eighteen months.

Automobile Industry

Modern vehicles rely on microchips to execute several vital functions. According to the Washington Post, nearly 17 car manufacturers in North America and Europe had slowed or stopped production due to a lack of computer chips. Major automakers like Tesla, Ford, BMW, and General Motors have all been affected. The major implication is that the global automobile industry will manufacture 4 million fewer cars by the end of 2021 than earlier planned, and it will forfeit an average of $110 billion in revenue.

Consumer Electronics

Consumer electronics such as desktop PCs and smartphones rose in demand throughout the pandemic, thanks to the shift to virtual learning among students and the rise in remote working. At the start of the pandemic, several automakers slashed their vehicle production forecasts before abandoning open semiconductor chip orders. And while the consumer electronics industry stepped in and scooped most of those microchips, the supply couldn’t catch up with the demand.

Data Centers

Most chip fabrication companies like Samsung Foundries, Global Foundries, and TSMC prioritized high-margin orders from PC and data center customers during the pandemic. And while this has given data centers a competitive edge, it isn’t to say that data centers haven’t been affected by the global chip shortage.

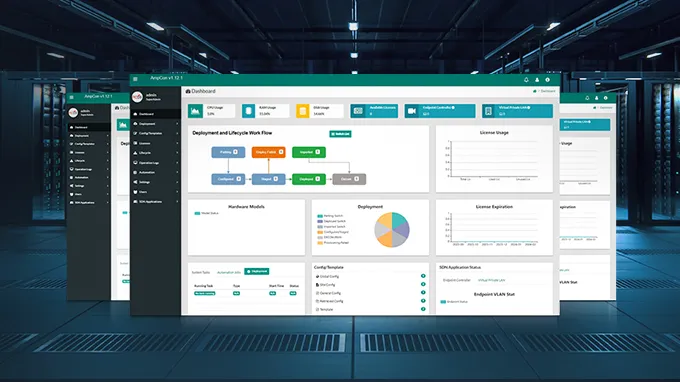

Some of the components data centers have struggled to source include those needed to put together their data center switching systems. These include BMC chips, capacitors, resistors, circuit boards, etc. Another challenge is the extended lead times due to wafer and substrate shortages, as well as reduced assembly capacity.

LED Lighting

LED backlights common in most display screens are powered by hard-to-find semiconductor chips. The prices of gadgets with LED lighting features are now highly-priced due to the shortage of raw materials and increased market demand. This is expected to continue up to the beginning of 2022.

Renewable Energy- Solar and Turbines

Renewable energy systems, particularly solar and turbines, rely on semiconductors and sensors to operate. The global supply chain constraints have hurt the industry and even forced some energy solutions manufacturers like Enphase Energy to suffer share losses.

Semiconductor Trends: What to Expect Moving Forward

In response to the global chip shortage, several component manufacturers have ramped up production to help mitigate the shortages. However, top electronics and semiconductor manufacturers say the crunch will only worsen before it gets better. Most of these industry leaders speculate that the semiconductor shortage could persist into 2023.

Based on the ongoing disruption and supply chain volatility, various analysts in a recent CNBC article and Bloomberg interview echoed their views, and many are convinced that the coming year will be challenging. Here are some of the key takeaways:

Pat Gelsinger, CEO of Intel Corp., noted in April 2021 that the chip shortage would recover after a couple of years.

DigiTimes Report found that Intel and AMD server ICs and data centers have seen their lead times extend to 45 to 66 weeks.

The world’s third-largest EMS and OEM provider, Flex Ltd., expects the global semiconductor shortage to proceed into 2023.

In May 2021, Global Foundries, the fourth-largest contract semiconductor manufacturer, signed a $1.6 billion, 3-year silicon supply deal with AMD, and in late June, it launched its new $4 billion, 300mm-wafer facility in Singapore. Yet, the company says its production capacity will only increase component production earliest in 2023.

TMSC, one of the leading pure-play foundries in the industry, says it won’t meaningfully increase the component output until 2023. However, it’s optimistic that the company will ramp up the fabrication of automotive micro-controllers by 60% by the end of 2021.

From the industry insights above, it’s evident that despite the many efforts that major players put into resolving the global chip shortage, the bottlenecks will probably persist throughout 2022.

Additionally, some industry observers believe that the move by big tech companies such as Amazon, Microsoft, and Google to design their own chips for cloud and data center business could worsen the chip shortage crisis and other problems facing the semiconductor industry.

In a recent Bloomberg Businessweek article, the authors hint that the entry of Microsoft, Amazon, and Google into the chip design market will be a turning point in the industry. These tech giants have the resources to design superior and cost-effective chips of their own, something most chip designers like Intel have in limited proportions.

Since these tech giants will become independent, each will be looking to create component stockpiles to endure long waits and meet production demands between inventory refreshes. Again, this will further worsen the existing chip shortage.

Possible Solutions

To stay ahead of the game, major industry players such as chip designers and manufacturers and the many affected industries have taken several steps to mitigate the impacts of the chip shortage.

For many chip makers, expanding their production capacity has been an obvious response. Other suppliers in certain regions decided to stockpile and limit exports to better respond to market volatility and political pressures.

Similarly, improving the yields or increasing the number of chips manufactured from a silicon wafer is an area that many manufacturers have invested in to boost chip supply by some given margin.

Here are the other possible solutions that companies have had to adopt:

Embracing flexibility to accommodate older chip technologies that may not be “state of the art” but are still better than nothing.

Leveraging software solutions such as smart compression and compilation to build efficient AI models to help unlock hardware capabilities.

Summary

The latest global chip shortage has led to severe shocks in the semiconductor supply chain, affecting several industries from automobile, consumer electronics, data centers, LED, and renewables.

Industry thought leaders believe that shortages will persist into 2023 despite the current build-up in mitigation measures. And while full recovery will not be witnessed any time soon, some chip makers are optimistic that they will ramp up fabrication to contain the demand among their automotive customers.

That said, staying ahead of the game is an all-time struggle considering this is an issue affecting every industry player, regardless of size or market position. Expanding production capacity, accommodating older chip technologies, and leveraging software solutions to unlock hardware capabilities are some of the promising solutions.

Added

This article is being updated continuously. If you want to share any comments on FS switches, or if you are inclined to test and review our switches, please email us via media@fs.com or inform us on social media platforms. We cannot wait to hear more about your ideas on FS switches.

You might be interested in

Email Address

-

PoE vs PoE+ vs PoE++ Switch: How to Choose?

May 30, 2024